International arbitration in 2021

Investment claims: project finance lenders have rights too

A recent award has opened the door for project finance lenders to seek compensation under international investment treaties.

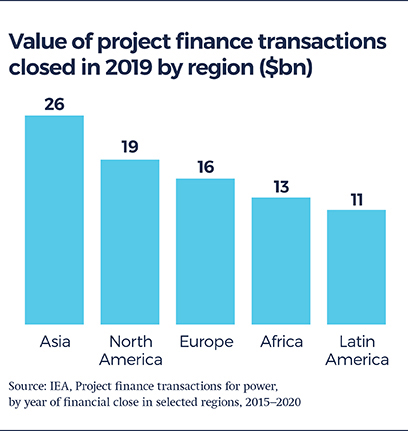

Project finance is critical to the construction of many energy, infrastructure, transport and industrial projects. In the energy sector alone, project finance transactions closed in 2019 globally amounted to $85bn.

In addition to their economic importance, the commercial and investment risks borne by project finance lenders are significant. Among those risks is the possibility that governmental actions detrimentally affect a project’s cash flows and, as a result, its ability to repay the project financing. Equity investors in projects often benefit from investment treaties that grant them protections against certain adverse State measures, including the right to seek compensation for damages arising from such actions through international arbitration. In contrast, it was unclear whether project finance lenders had access to such protections, despite the scale of their investments and of the risks they bore. That is, until the recent decision by the arbitral tribunal in Portigon AG v Spain.

Portigon AG v Spain extends treaty protections to project finance lenders

In Portigon, the claimant had provided project financing to various renewable energy projects in Spain, which were detrimentally impacted by Spain’s repeal of previously established incentives and a remuneration framework for such projects. The tribunal’s jurisdictional decision, dated 20 August 2020, for the first time upheld the authority of arbitrators under an investment treaty (in this case, the Energy Charter Treaty) to decide claims by a project finance lender with respect to measures that were not directed against the financing itself, but rather against the financed project. This decision effectively extends investment treaty protections to project financing and project finance lenders.

We expect an increasing number of project financiers to use investment treaty arbitration or at least the threat of arbitration to oppose unlawful State measures directed against financed projects and, if necessary, seek damages arising from such measures.

What protections are available to lenders?

International investment treaties stipulate specific protection standards for the benefit of foreign investors, including, among other things, protections against inequitable, arbitrary or discriminatory treatment, and expropriation without prompt and adequate compensation. Critically, investment treaties typically also provide investors with recourse to international arbitration directly against the government of sovereign States.

States may impair foreign investments in a variety of ways, including through legislative, administrative or even judicial acts. In the context of project finance investments, adverse State measures can take many forms, including:

- the repeal of a previously established remuneration regime including incentives and benefits for such projects (either by law or contract);

- breaches of contractual agreements entered into with State-owned entities; or

- the unilateral modification, termination or denial of concessions, permits or licences.

When State actions like these breach applicable investment treaties, the State must compensate the investor. For project finance lenders, potential damages might include losses suffered on long-term loan agreements, as well as other financial instruments (such as interest rate swaps) related to the project financing in question.

What do lenders need to do to be protected?

To ensure that recourse to investment treaty protections is available when needed, it is vital that lenders keep an eye on several issues:

- evaluate the structures of their transactions to ensure the availability of optimal investment treaty Investment treaty protection depends on the nationality of the party claiming protection (in this case, the lender). Providing the financing through the parent company or its branches or subsidiaries incorporated in different jurisdictions may have a significant impact on the investment protection available. A preliminary legal due diligence on the array of treaties available is therefore advisable;

- maintain detailed records of their reliance on the host State’s As a third party to the relationship between the State and the project sponsors, it is important for lenders to keep a detailed record of any documentary evidence showing their reliance on certain State commitments (eg due diligence reports on statutory tariffs, governmental permits as conditions precedent, where available). Any direct interaction between the State and the lender will foster the lender’s claim even where formal direct agreements with governmental agencies may not be available; and

- draft with utmost care transfer, assignment and syndication agreements to preserve treaty protection when syndicating, assigning or transferring the financing to third parties and clarify the entity (or entities) that can avail themselves of it.

Project finance lenders have an opportunity to protect themselves against the risk of future adverse State measures that impair the economic viability of projects that they have financed. We are particularly well placed to advise lenders on their risk and investment strategy to secure the benefit of any available investment treaties.

International arbitration in 2021

- Introduction

- The future of remote hearings in a post-pandemic world

- COVID-19-related disputes: trends and predictions

- Insolvency and arbitration

- Arbitration in the EU and UK: a changing landscape

- The future of investor-State dispute settlement

- Investment arbitration trends

- Investment claims: project finance lenders have rights too

- Latest arbitral rules reforms

- Continuing economic woes for the construction and infrastructure sectors

- Arbitrators’ duties of disclosure in the spotlight

- Arbitration and climate change